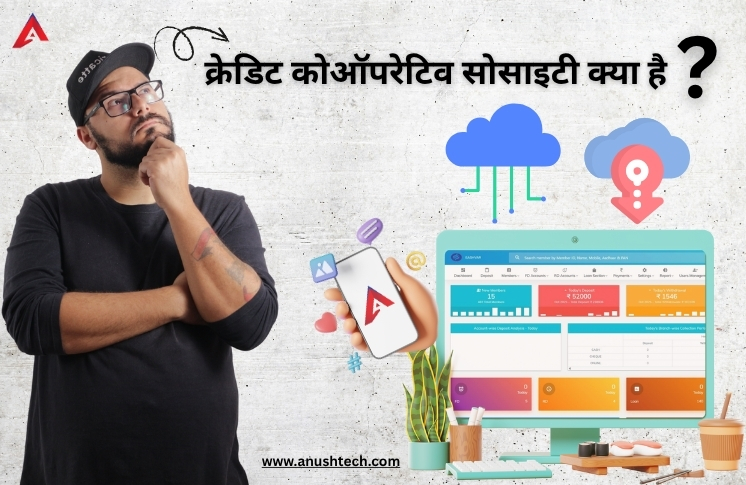

Simplifying Credit Society Management Digitally

Streamline credit co-operative society operations with secure, automated software for managing members, loans, deposits, accounting, and multi-branch operations efficiently.

Anush Technology – Comprehensive Software Solutions for Credit Co-operative Societies

Managing a credit co-operative society is a complex task. From member registration and loan processing to deposit tracking, accounting, and multi-branch operations, society administrators face several challenges. Anush Technology provides a dedicated, cloud-based software solution designed to simplify every aspect of co-operative society management, making operations efficient, accurate, and transparent.

What is a Credit Co-operative Society?

A Credit Co-operative Society is a member-owned financial organization where individuals pool their resources to provide loans, credit, and savings options to members. These societies are governed under the Co-operative Societies Act, promoting financial inclusion, savings culture, and community lending.

- Member-driven governance – Members participate in decision-making.

- Financial services – Loans, deposits, and savings options for members.

- Profit-sharing – Surplus is distributed among members.

- Transparency and accountability – Accurate record-keeping and reporting are essential.

- Regulatory compliance – Must follow state and national co-operative laws.

Challenges Faced by Credit Co-operative Societies

- Manual record-keeping leads to errors and discrepancies.

- Time-consuming loan and deposit tracking.

- Delayed financial reporting and audits.

- Difficulty in managing multiple branches.

- Limited communication with members about updates, loans, or deposits.

- Compliance risk due to inaccurate or delayed data.

How Anush Technology Transforms Society Management

Anush Technology offers a comprehensive software solution that automates and manages all operations of a credit co-operative society. The software streamlines processes, reduces errors, and ensures regulatory compliance.

1. Member Management

- Automated registration and KYC process.

- Complete member profiles, nominee details, and branch-specific records.

- Centralized dashboard for easy tracking and updates.

2. Loan Management

- Automates loan applications, approvals, and EMI calculations.

- Tracks repayments, overdue accounts, and interest rates.

- Generates detailed loan reports for management and auditors.

3. Deposit & Savings Management

- Handles fixed deposits, recurring deposits, and savings accounts.

- Real-time monitoring of all branches.

- Generates member-specific deposit statements and reports.

4. Accounting & Financial Reporting

- Generates audit-ready financial statements, balance sheets, and P&L reports.

- Tracks every transaction through automated ledger entries.

- MIS reports help in strategic decision-making.

5. Notifications & Alerts

- SMS and email alerts for members about loans, deposits, and other updates.

- Improves communication and builds member trust.

6. Multi-Branch Management

- Manage multiple branches under a single platform.

- Centralized control with branch-specific workflows.

- Scalable for small, medium, and large societies.

7. Security & Compliance

- Cloud-based software with data encryption.

- Role-based access for admins, staff, and auditors.

- Compliant with co-operative society regulations.

Key Features of Anush Technology Credit Co-operative Society Software

- Member Management – Register, update, and manage members easily.

- Loan Management – Automated loan processing, EMI, and repayment tracking.

- Deposit Management – Manage savings, recurring deposits, and fixed deposits.

- Accounting & Finance – Complete financial management with audit-ready reports.

- MIS Reporting – Customizable reports for branch and society-level insights.

- Notifications – Automated SMS/email alerts for timely updates.

- Multi-Branch Management – Control all branches under one platform.

- Security & Scalability – Cloud-based, encrypted, and adaptable for growth.

Benefits of Implementing Anush Technology Software

- Automation of routine tasks – reduces manual work and errors.

- Improved accuracy – reliable financial calculations and record-keeping.

- Time efficiency – staff can focus on member services instead of paperwork.

- Enhanced transparency – members and auditors can access accurate information anytime.

- Better decision-making – real-time reports support strategic planning.

- Scalability – from single branch to multi-branch management.

- Member satisfaction – timely notifications, transparent records, and faster service.

Use Cases: How Societies Benefit

- Small societies – simplify member, loan, and deposit management.

- Medium societies – automate accounting, reporting, and member communication.

- Large multi-branch societies – centralized control, audit-ready compliance, and multi-branch operations.

- Government or educational societies – maintain transparent and secure records for regulatory compliance.

Why Choose Anush Technology

- Tailored for co-operative societies – not a generic ERP; designed specifically for societies.

- All-in-one solution – covers member management, loans, deposits, accounting, reporting, notifications, and multi-branch operations.

- Automation & accuracy – minimizes errors, speeds up operations.

- 24×7 support – dedicated technical support ensures uninterrupted operations.

- Trusted by hundreds of societies – proven track record across India.

- Secure & scalable – cloud-based, encrypted, and adaptable to society growth.

Conclusion

Credit co-operative societies play a vital role in promoting financial inclusion and supporting community growth. However, managing them manually or with outdated tools can lead to inefficiencies, errors, and compliance risks.

Anush Technology provides a modern, cloud-based software solution that automates every aspect of society management — from member and loan management to accounting, reporting, notifications, and multi-branch operations.

With Anush Technology, co-operative societies can focus on serving members, improving transparency, efficiency, and accuracy, and ensuring sustainable growth.

Empower your credit co-operative society with Anush Technology – the trusted software solution for efficient, reliable, and secure management.